Nachhaltigkeit

trifft auf

Intelligenz

Think Sustainability

Think CorpStage

Unsere ESG-Reise

Wir bieten fachkundige Beratung, um Unternehmen bei der Integration von ESG-Prinzipien in ihre Geschäftstätigkeit zu unterstützen.

Willkommen bei CorpStage, dem weltweit anerkannten ESG-Beratungsunternehmen. Wir haben uns auf Lösungen spezialisiert, die einen messbaren nachhaltigen Wert schaffen. Dazu gehören ESG-Zertifizierungen, Analysen des CO2-Fußabdrucks und ansprechende Kurse und Workshops zum Aufbau von Kapazitäten. Unsere Dienstleistungen konzentrieren sich auf greifbare Auswirkungen und geben Unternehmen die Werkzeuge an die Hand, um bei nachhaltigen Praktiken und ethischem Wachstum führend zu sein.

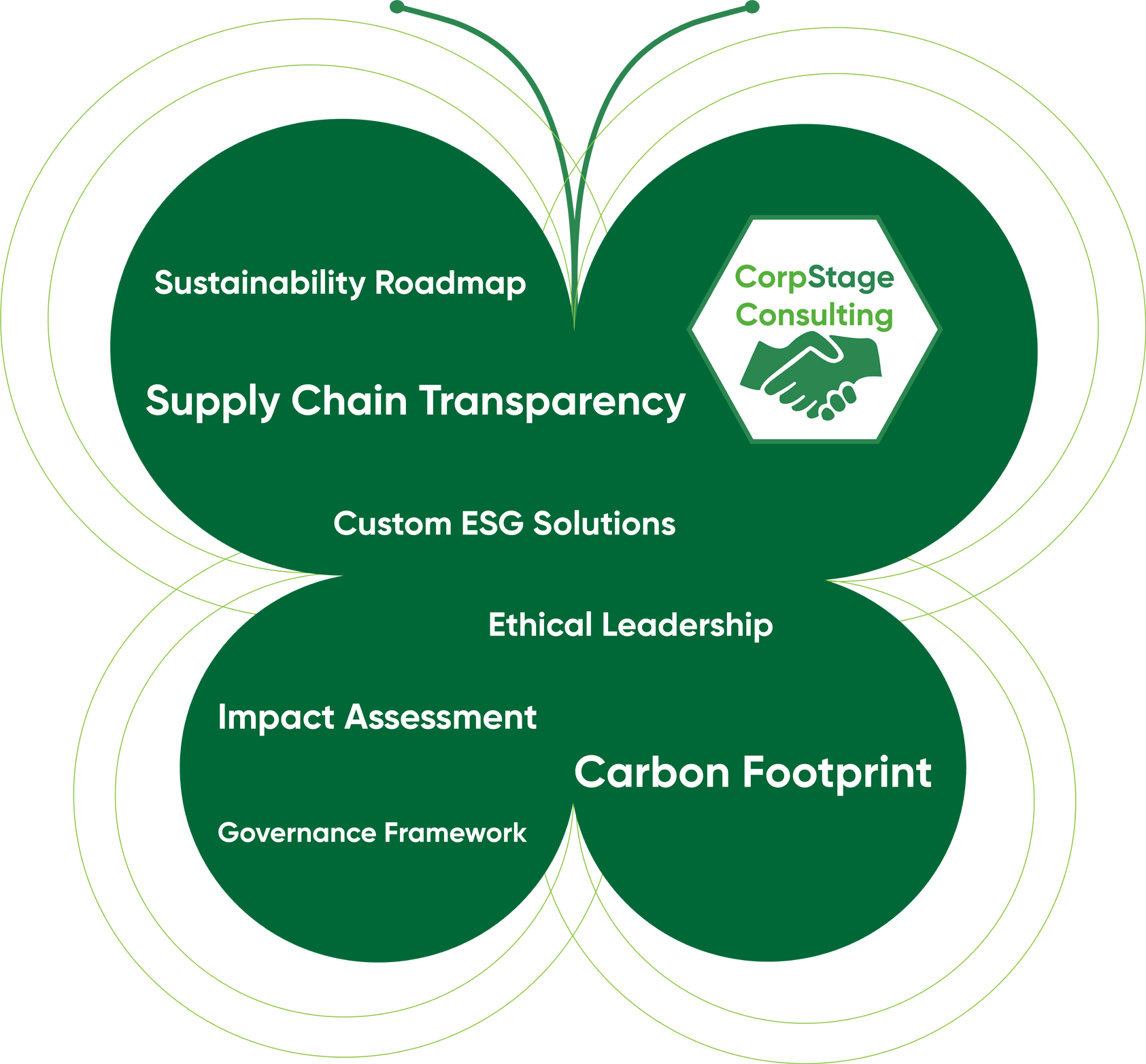

CorpStage ESG-Beratung Dienstleistungsmodule

ESG-Strategieentwicklung

Wir helfen Unternehmen bei der Erstellung individueller ESG-Pläne, einschließlich Risikoanalyse und Zielsetzung.

Bewertung der Wesentlichkeit

Identifizieren Sie die wichtigsten ESG-Themen, die für das Unternehmen relevant sind.

Analyse und Einbeziehung von Stakeholdern

Dienstleistungen für die Identifizierung von und den Umgang mit wichtigen Interessengruppen.

Berater für die Einhaltung gesetzlicher Vorschriften

Unterstützung beim Verständnis der ESG-Vorschriften in verschiedenen Regionen und Branchen.

Lückenanalyse und Roadmap-Planung

Bewertung der aktuellen ESG-Praktiken und Entwicklung eines Fahrplans zur Schließung von Lücken.

Branchenspezifische Beratung

Spezialisierte Dienstleistungen für Branchen wie das Finanzwesen, die verarbeitende Industrie, das Gesundheitswesen usw., um deren besondere ESG-Herausforderungen zu bewältigen.

Unser ESG-Rahmenwerk

- Die 6 E für

ESG-Erfolg

ESG Kante

Mit esgEdge bietet CorpStage Webinare an, die von Branchenführern geleitet werden, um Unternehmen zu inspirieren und sie über nachhaltige Praktiken zu informieren. Erweitern Sie Ihr Wissen, überdenken Sie bestehende Modelle und machen Sie Ihr Unternehmen skalierbarer und zukunftssicherer, indem Sie von realen Nachhaltigkeitsprojekten lernen.

ESG Sicherstellen

esgEnsure bietet Tools zur Beurteilung und Bewertung des Nachhaltigkeitsstatus Ihres Unternehmens und vergleicht ihn mit den besten Praktiken der Branche. Sie erhalten einen Nachhaltigkeits-360°-Bericht mit Einblicken in Ihre aktuelle Leistung und Vorschlägen für den langfristigen Erfolg, um sicherzustellen, dass Ihre Nachhaltigkeitsziele auf dem richtigen Weg sind.

ESG Aktivieren

Mit esgEnable unterstützt CorpStage Unternehmen bei der Strategieentwicklung und der Umsetzung nachhaltiger KPIs. Unser praxisorientierter Beratungsansatz geht über herkömmliche Präsentationen hinaus und bietet echte Strategien, die sich direkt in Ihr operatives System integrieren lassen und eine nachhaltige Wirkung erzielen.

ESG Engage

Die Einbindung von Stakeholdern ist entscheidend für nachhaltigen Erfolg. Mit esgEngage bietet CorpStage Tools, darunter die Onstage-Plattform, die ein effektives Engagement erleichtern und die Bedürfnisse der Stakeholder in erreichbare Unternehmensziele übersetzen, die das Rückgrat einer erfolgreichen Strategieentwicklung bilden.

ESG Erweitern

Ganzheitliche Zusammenarbeit ist der Schlüssel zu wirkungsvoller Nachhaltigkeit. esgExtend bringt Investoren, Regierungen, Industrie und akademische Partner durch die CorpStage-Initiativen SCOPE und Pod zusammen, um lokale Bedürfnisse mit optimalen Lösungen anzugehen und sektorübergreifende Kooperationen zu fördern, die nachhaltiges Wachstum vorantreiben.

ESG Elevate

Mit esgElevate konzentriert sich CorpStage auf die Messung der Ergebnisse und des Outputs von Nachhaltigkeitsinitiativen. Durch die Bewertung dieser Erträge helfen wir Unternehmen, interne Mittel freizusetzen und neue Investitionen für Nachhaltigkeitsprojekte zu gewinnen, die Investoren, Mitarbeitern, Kunden und der Welt zugute kommen.

Unsere Partner:

Unsere größte Stärke

Ihr Erfolg ist unser Ziel, Ihre Vision ist unsere Mission

Gazala Sheikh, Cso- L&t Finance

Rony J Palathinkal, Ceo Of Greenarc Capital