The 5 Hidden Costs of Manual ESG Reporting and How to Eliminate Them

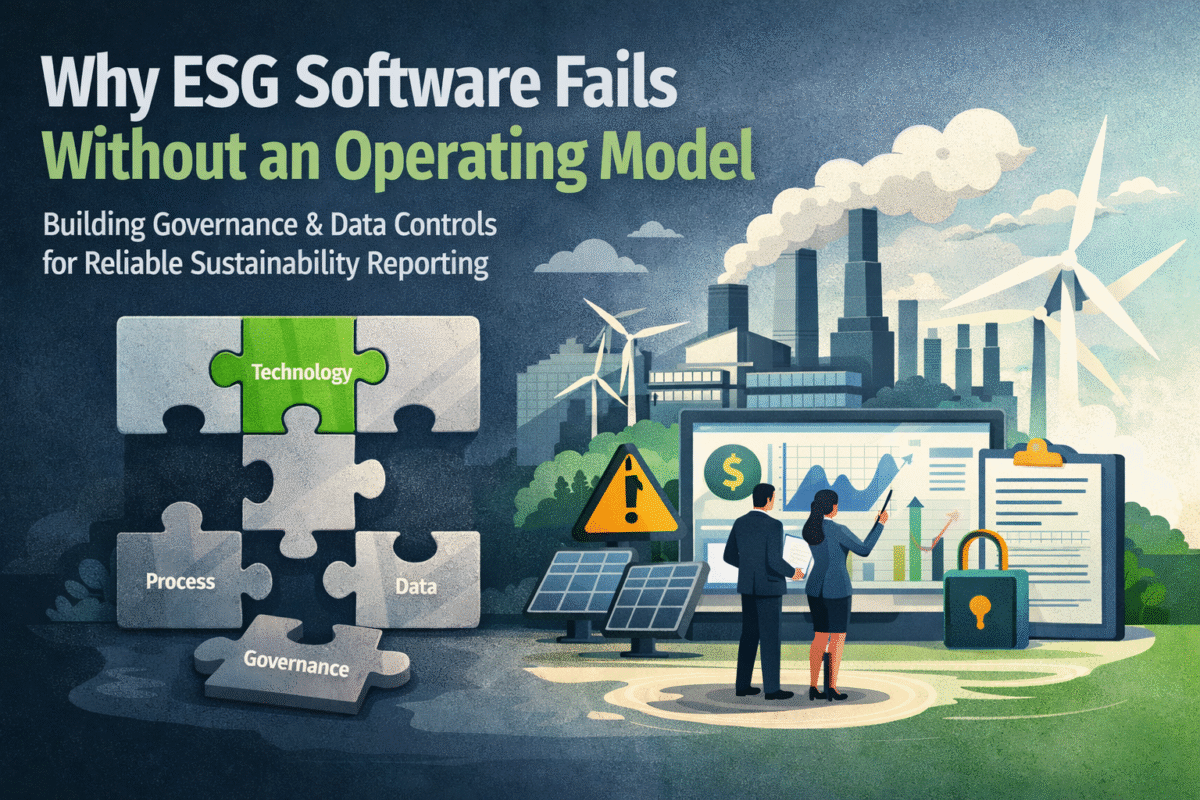

Sustainability reporting is no longer a nice-to-have but rather a regulatory or strategic need. Increasing organizational pressure is growing to publicize environmental, social, and governance (ESG) data transparently across organizations across sectors. Although most companies continue to do ESG reporting manually through the use of spreadsheets and email chains, this cumbersome process can create a hidden cost structure that may chip away at value and leave companies vulnerable to a variety of risks.

This blog examines five of these lurking expenses and how adopting automated ESG reporting can help alleviate those problems, enhancing accuracy, efficiency, and credibility.

Inaccurate and Inconsistent Data: The Silent Risk

The accuracy of ESG data is the basis of believable ESG reporting. Manual processes are also full of pitfalls, eccentricities, and slips. Think about all the different departments with a variety of teams using spreadsheets to enter data, copy information, or manually merge supplier information. There are many opportunities to make an error at each stage, including errors in formulae, typos, and disparities in units of measurement.

When ESG data constitutes a mosh pit of sources, including utility bills, HR databases, or even third-party websites, it is a passim of monolithic proportions to achieve consistency. Inaccurate or inconsistent data not only impacts the quality of the report but can also cause poor decision-making, regulatory issues, and reputation damage.

Automated ESG reporting enables businesses to centralize data collection and bring real-time validation checks to flag anomalies. Automation normalizes formats, prevents duplication, and only verifiable and trusted data can flow into the reporting system. Such a control level protects both the compliance position of the organization as well as its brand.

Compliance Risks and Regulatory Penalties

International sustainability regulation, like the EU Corporate Sustainability Reporting Directive (CSRD) and emerging regulation in the Asian and North American markets, is getting tighter by the year. Adherence cannot be compromised: failure to adhere to a timeline or deliver incorrect information can result in fines or even legal charges, not to mention loss of your reputation.

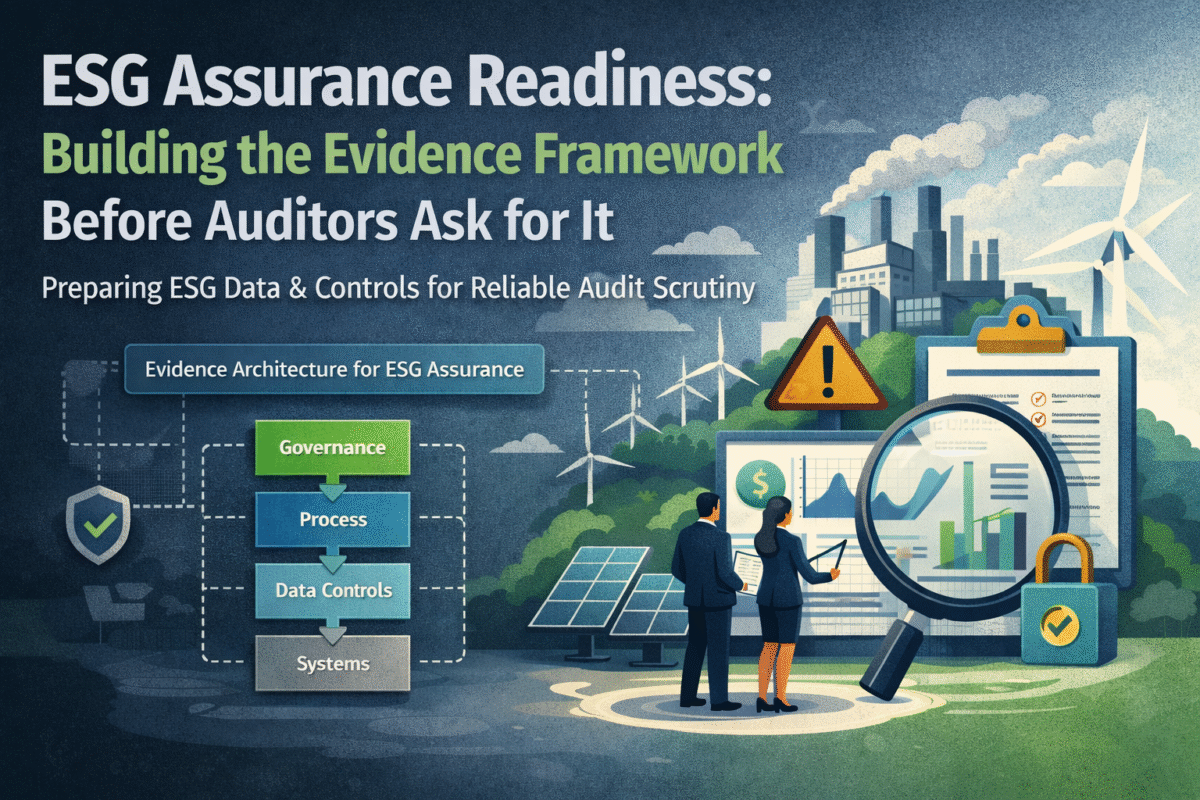

Manual reporting systems lack an inbuilt audit trail, and therefore, it is difficult to recreate compliance during regulatory check-ins. When the authors are required to provide evidence of where the data have been derived from or how the calculations were conducted, it can be a menace to compile them manually.

Automated systems, however, provide rich audit history and track each change as well as where it came from. This makes not only an easy task during compliance audits but also gives confidence to investors and regulators. Companies such as CorpStage allow smooth following of various reporting models without the hassle of manually doing the same.

Missed Strategic Opportunities Due to Delayed Insights

ESG does not only discuss compliance: it has become a strategic planning tool. Data on energy consumption, diversity metrics, and supply chain performance can be used to depict cost-saving opportunities, investment decisions, and improved positioning of the brands.

But as ESG data is kept on spreadsheets and dispersed across various functions, it is nearly impossible to derive insights. Taking time to consolidate data manually, the information becomes stale and thus has no relevance to inform choices in time.

Automated tools help to process raw data into actionable insights. Dashboards, real-time analytics, and forecasting models help an organization to determine trends, avoid resource wastage, and set achievable sustainability goals. Simply put, automation transforms the ESG reporting into a business opportunity.

Increased Operational Costs

Most organizations believe that manual reporting is more cost-effective since it does not require software subscriptions. The facts are otherwise. Manual routines require massive man-hours, numerous corrections, and coordination among many departments. Add in the expense of bringing in consultants to audit reports or rectify mistakes, and the cost grows rapidly.

Automation saves a lot of labor involved in ESG reporting. By automating the data collection and validation processes, companies allow their teams to spend more time planning instead of getting caught up in administrative work. In the long term, investment in automated systems has a much higher ROI compared to the assumed cost of manual systems.

Reputational Damage and Greenwashing Accusations

Modern-day stakeholders (investors and consumers) need the transparency and accuracy of sustainability reporting. Failure to comply is potentially catastrophic to a brand image and to the organization that acts with or on behalf of it. Such errors are even more probable and difficult to notice before publication because of manual processes.

Automated platforms increase credibility by making ESG information consistent, accurate, and traceable. Centralized data lakes, real-time validation, and compliance templates give businesses the assurance they require to publish reports without the fear of error. To be able to distinguish themselves and generate trust with customers, automation is no longer optional but only truly essential.

Eliminating the Hidden Costs: Why Automation is the Future

The five hidden costs of manual ESG reporting—accuracy, compliance risk, lost insights, operational efficiency, and reputational exposure—may drain resources and undercut competitive advantage without causing a splash. Manual ESG reporting is too risky and can hardly open new opportunities. The way to mitigate risk and open new opportunities is to switch to automated ESG reporting.

The new generation of companies like CorpStage includes a mixture of data validation automation, centralized data lakes, and dashboards in real time. These features automate compliance and decision-making and ensure that the business has the confidence to publish accurate and auditable reports without the burden of manual processes.

Automation does not involve a replacement of people but rather empowering teams to focus more on the strategic side instead of administrative monotony. The shift will make ESG reporting a growth, rather than a cost center.

Final Thoughts

Manual ESG reporting may appear to be safe and comfortable; however, in reality, it ends up being expensive, hazardous, and unsustainable. The risks that are not seen until it is too late include the loss of lives, loss of business, and loss of reputation, which outweigh the cost savings of short-term goals. With the increasing level of regulation on the global front and trends in changing stakeholder expectations, businesses that do not adapt will be left behind.

Automation has become a reality, and the future is of organizations that not only say that they are sustainable but also become sustainable. Given the right investments in tools and processes, firms can ensure that ESG reporting will spur innovation, resilience, and long-term growth.

Visit for more: https://www.corpstage.academy/